Streamline financial management and quick growth

The Finance module in Aqxolt ERP provides real-time insight into the overall financial status of the organisation. It provides, automates and streamlines the entire financial management process, as well as simplifies user adoption and processes by its seamless integration.

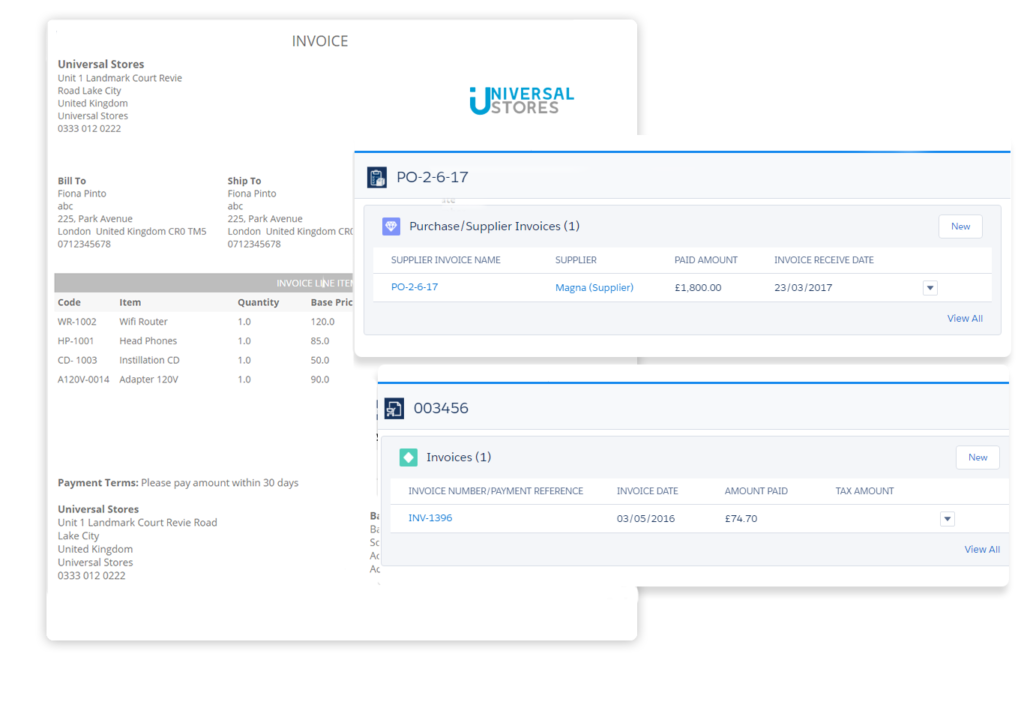

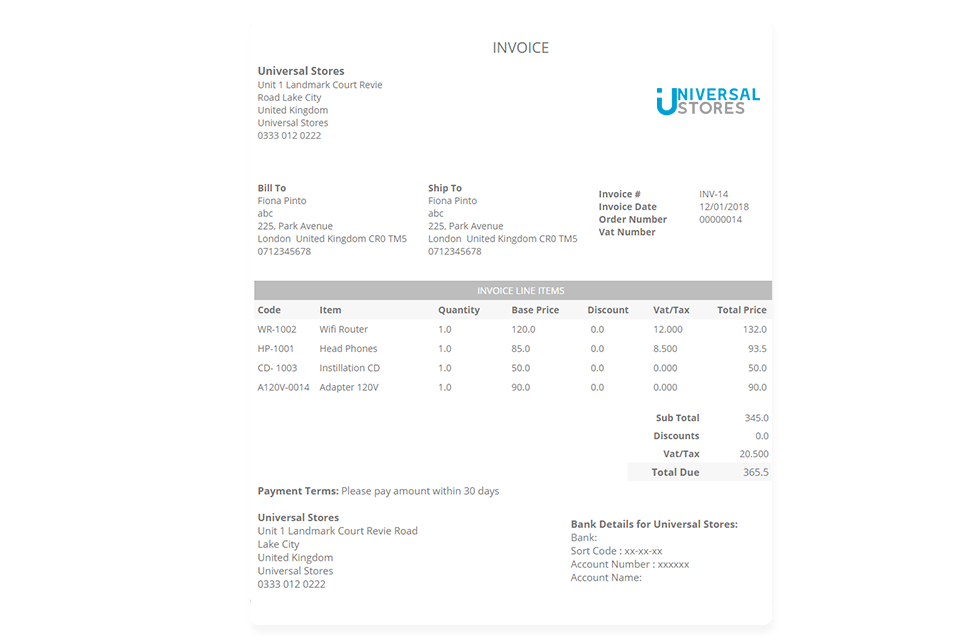

Customer and Supplier Invoices

Create customer invoice from a sales order and supplier invoice from a purchase order. Post the invoice documents easily and update the financial history.

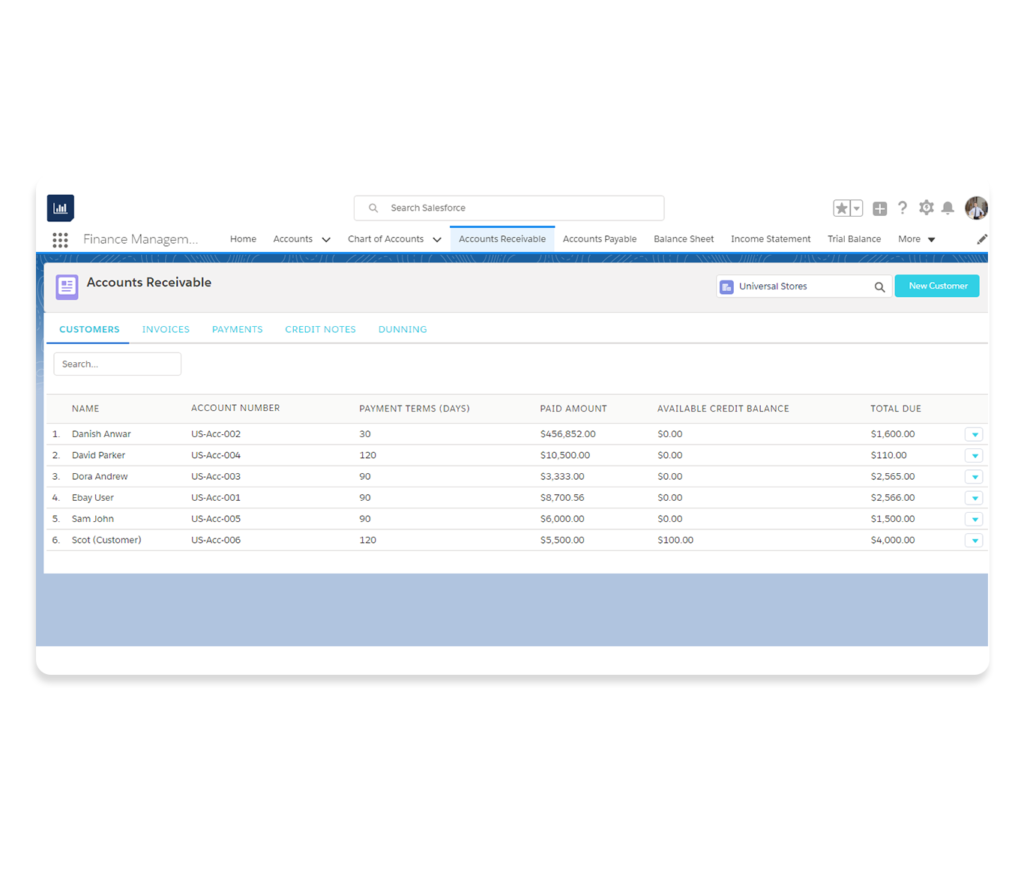

Accounts Receivable

Automated entries on every sale based on the type of payment transactions. Identify customers that owe to the organisation. Streamlined internal accounts receivable process. Accept full or partial payments and also accept pre-payments for orders.

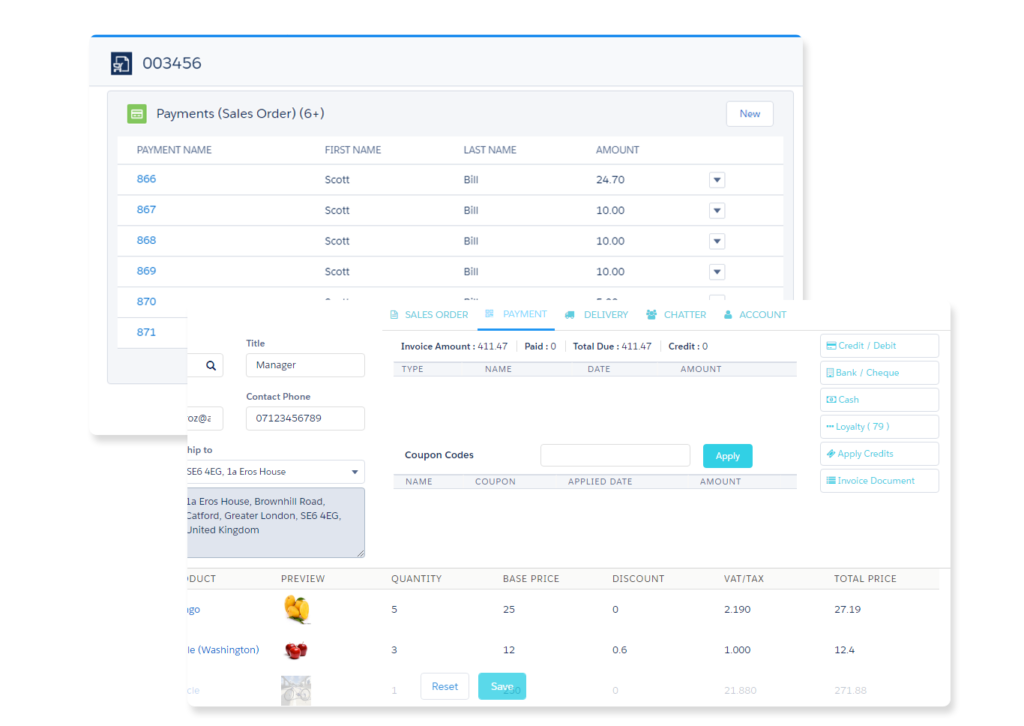

Payments

Accept payments via cash, bank, cheque, debit and credit cards. For credit and debit card transactions PayPal and Authorise.net is integrated with Aqxolt ERP. Apply pre-payments for partial or full payments.

Generation of Invoices

Invoices are an extremely important element of any business transaction. They formalize the entire process and provide an important record of sales/purchases made not to mention they are an integral part of sales management.

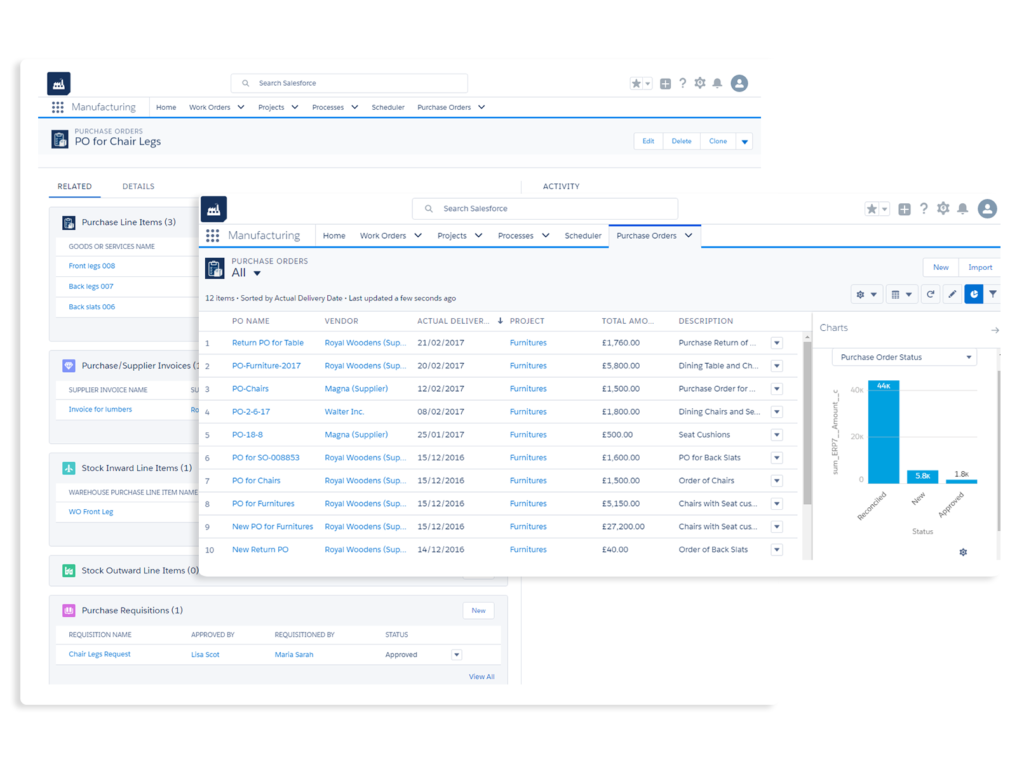

Purchase Order

Issue a purchase order (PO) to the seller, indicating types, quantities, and agreed prices for products. Sending a PO document to a supplier constitutes a legal offer to buy products or services.

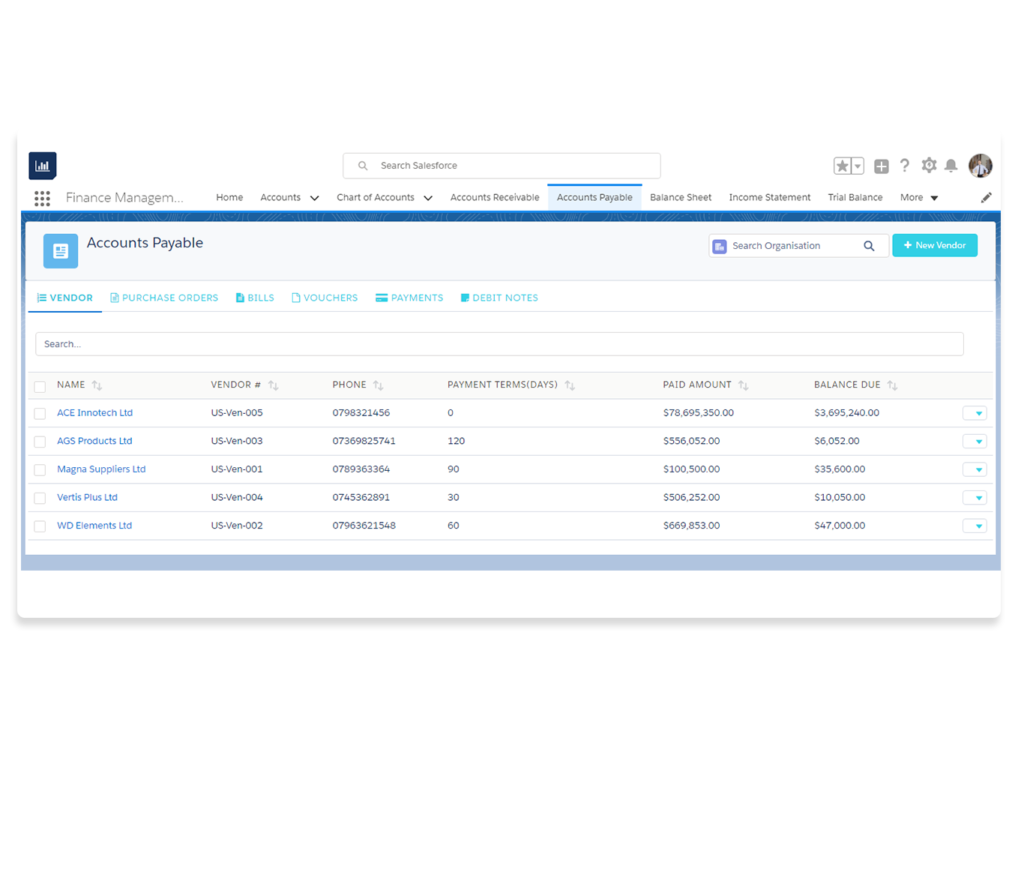

Accounts Payable

Capable of classifying various transactions in to accounts payable and receivable. Easily access information pertaining to accounts payable using customisable drill down balance sheet. Managing credit/ debit notes for sales return and purchase returns respectively.

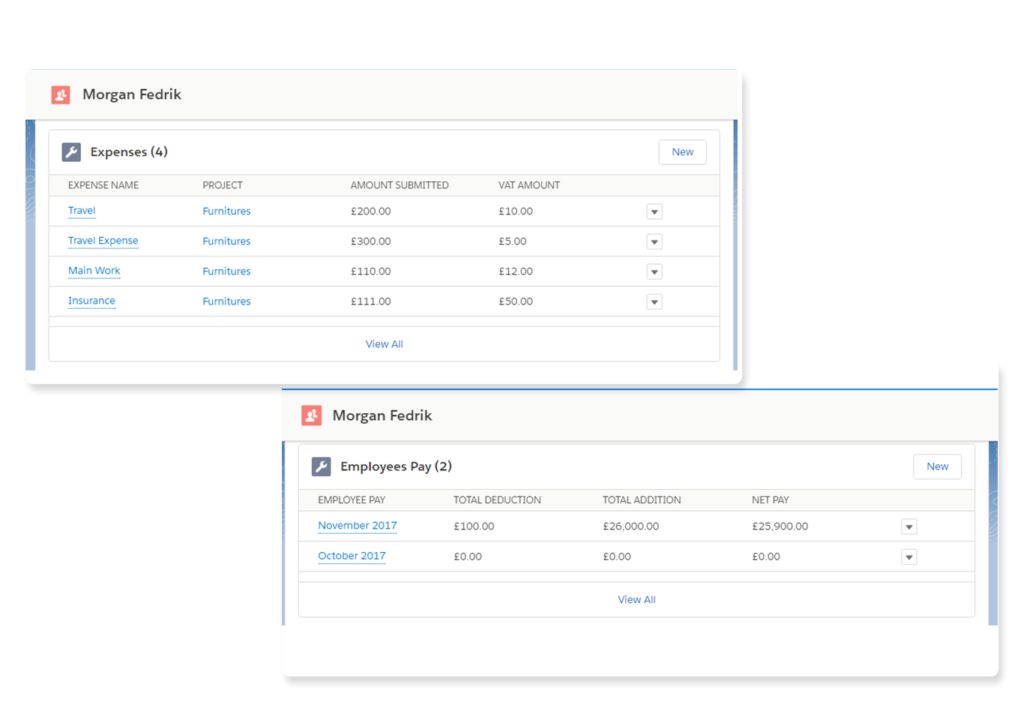

Expense Management

Manage all employee pay, expenses within one system eliminating the need to cross reference to other data sources, and provide prompt payment by faster approvals and processing.

Tax Receipts

Capture Taxes automatically, quickly reconcile Input and Output taxes. Easier and faster accounting closures.

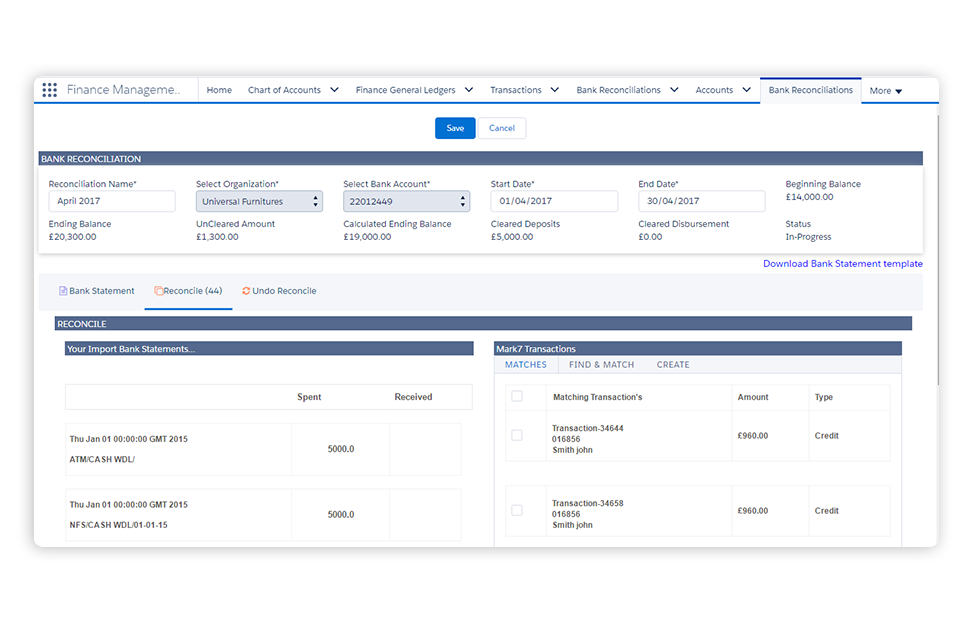

Bank Reconciliation

Bank reconciliation allows the comparison of bank balance shown in an organization’s bank statement, as supplied by the bank with the balance recorded by the system.

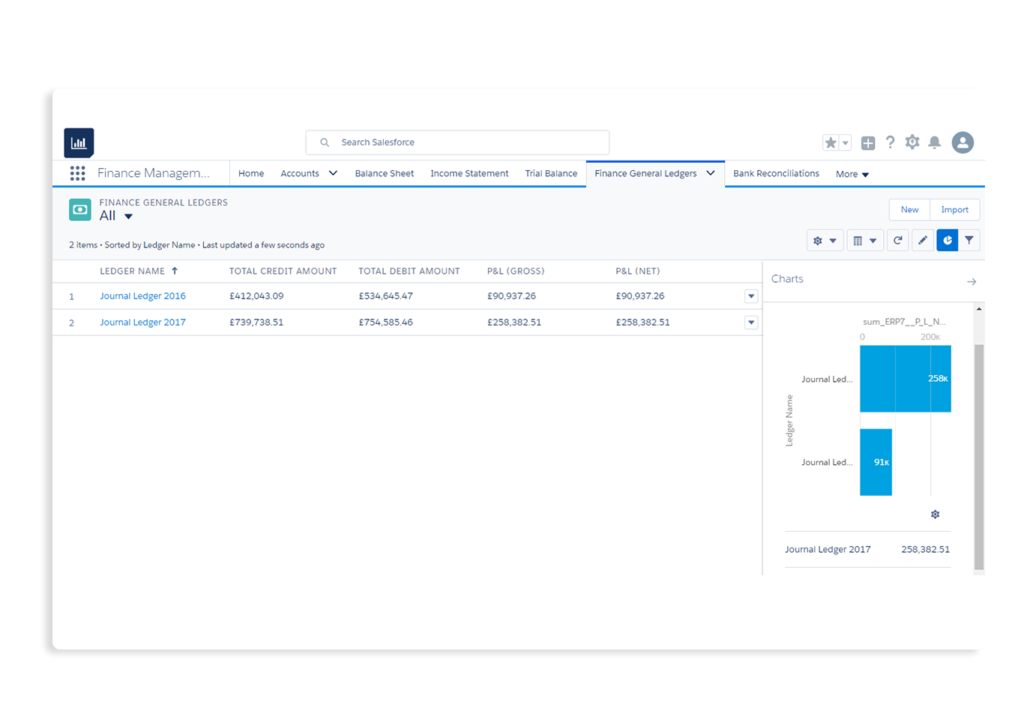

General Ledger

Quick view of individual accounts of suppliers, invoices, credit notes received and payments made. Manage spending, optimizing resources, complying with financial reporting requirements, capturing growth opportunities and streamlining financial operations, business becomes better and improved.